What is FICO? What Credit Score is Good, Bad or Average?

Among the many numbers that accompany us throughout life, our credit scores are one of the most important. The usual range of credit score varies from 350-800 while some model range up to 900. People with higher than 750 are able to attain best interest deals and insurance premiums while consequently, people having low scores get higher interests and higher premiums. In order to have your credit score improved, one must be able to understand what makes up the rating as a whole.

Watch this video and learn.

Video Rating: 5 / 5

How does declined credit card applications affect your score?

Question by Project EX: How does declined credit card applications affect your score?

Hello, i applied for 2 credit card applications within a week and got declined. This is because, i am 18, and only have 2 bank accounts with no credit on file. When i paid $ 15 yesterday to see my credit score, it reported as having “no score”. So i guess my declined accounts don’t count, expect for the inquiry right?

And say i do have credit, how much does a decline account do for a credit card.

Also 1 more question: What is the easiest card to get, ive tried:

1. Texaco

2. Best Buy

3. Bank of America

any ideas?

Best answer:

Answer by Mary F

Credit card declinations are not reflected in your credit report but a lot of inquiries can hurt your score. If I were you I would consider trying to get a credit card through your bank or try a local credit union. If you need to get a secured credit card where the amount of deposit you put in equals the credit line. Charge some small purchases but pay off the entire balance every month. You also want to show a payment as agreed history. My husband and I have superior credit (over 850 scores) He has limits of $ 25,000 or more on some of his cards. Believe me when I married him I was coming into the marraige with a Chapter 7 bankruptcy and by following this advice I am in Credit Heaven. Good Luck!!

Add your own answer in the comments!

Categories: Credit Score Questions Tags: affect, Applications, Card, Credit, declined, Score

Six Credit Score Myths Debunked

Knowing your credit score is crucial. It’s a vital part of your financial life. It affects your credit interest rates, the amount you pay on car loans, and mortgages. It even has a say on whether you could land a specific job or not.

You have total control of your credit score. Its standing is actually up to you. Spare a few minutes of your time and watch this video and know the things you can do in order to take good care of your score.

Categories: Credit Score Videos Tags: Credit, Credit Score Explanation, Myths, Score

How to Build A Good Credit Score

People who are aiming to buy expensive new gadgets, a new home or even a new car will often need the loans provided by banks. Yet in order to be able to apply for one, a person must have a very good credit score. Otherwise, banks and lending establishments will turn your application down. This article will explain what this credit score is all about and the steps that a person can take to boost it.

The various systems used to determine a person’s credit score were invented in order to create a certain standard method of gauging clients and their ability to pay their own credits. This scoring system ranges from 300 to 800; consequently, the higher the rating, the more chances that banks will allow you to have loans and credit deals. Banks and lending companies do not usually give loans to people having scores that are below the six or five hundred point marks.

One of the simplest things one can do in order to keep his score high is just paying bills on time. One or two delays can pretty much screw things up. People who are not keen payers will soon realize that they are being turned down almost everywhere they go. One must make a calendar as to when certain bills are to be paid, so that he will have a timetable as to what bills are of high priority to be settled as soon as possible. One can even allow their banks to transfer his money and pay for these bills at the end of each month to avoid any delays.

If a person has received his newly approved credit card, he might be very well tempted to use it all up all at once. This is somewhat not advisable. He must never use more than 40 or 50 percent of what is left of his total money. This will give banks and lending companies a gauge that this person is responsible enough for his money. These steps, if followed, will surely help a person save money and obtain a good credit score that will soon help him in ways he could have not foreseen.

Related Good Credit Articles

Categories: Credit Score Articles Tags: Credit, Credit Score, Loan, Score

Q&A: How many points are taken off your credit score when you cancel a credit card?

Question by Janice: How many points are taken off your credit score when you cancel a credit card?

I have 3 different credit cards from my bank and I just learned that they will be charging annual fees for each one very soon. I have these cards only because one was first time card (no offers). The next one had point rewards and the newest one had cash back. How many points will I lose from my “credit score”? Is there a sequence of time I should be concerned about as well..Oldest vs. newest?

I have to cancel at least cancel one or two.

P.S. I am in good standing with all 3.

Best answer:

Answer by Judy

Closing accounts hurts your rating in two ways.

1. Closing your oldest account will wipe out part of your history.

Length of credit history is 15% of your FICO.

2. You will be reducing your overall available limit on your cards.

But if you are paying fees, close them. There are plenty of cards out there without them.

How long until they will start charging you? I would open a new credit card before closing my oldest account.

Remember for pristine credit scores never carry a balance. Pay your bill in full each month and get 800+ scores.

Add your own answer in the comments!

Q&A: Is this a secret you can do with credit cards to raise credit score?

Question by : Is this a secret you can do with credit cards to raise credit score?

They recently bought a microwave for $ 1000 on credit. They have way more than that though and when the bill came, they only paid $ 970 on purpose. I asked them why they didn’t pay it off in full and they said that they paid it with $ 30 short because there is barely any interest to that low sum of cash as opposed to only paying $ 600 where the interest would be equal to a lot more money for a sum of $ 400 as opposed to $ 30.

They said that “We just left $ 30 for the them to play around with and because we pay a little amount of interest on purpose, it makes them happy and they raise the credit score.”

So I asked what makes them so sure that that happens and they said that it’s experience after working with credit cards for 30+ years.

my parents*

Best answer:

Answer by Reena

They are wrong…. the credit card company has no influence over the credit bureaus and the credit scores.

So, leaving $ 30 on the card to give the credit card company a morsel of interest does not do anything towards their credit score.

What matters is that all payments are made on time, that not too much of the credit line is used in a billing cycle and that they (your parents) have a lot of “unused” credit versus maxed out cards and of course that they had these credit cards for a long time.

But you won’t be able to convince them. They have 30 years of “experience” and that is how they see it.

What do you think? Answer below!

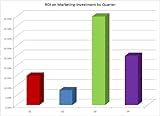

Marketing Plan Template for Credit Score Repair Service Business MS Word / Excel

Marketing Plan Template for Credit Score Repair Service Business MS Word / Excel

- Complete Marketing Plan Template Pre-Populated With All Necessary Sections

- Comes in MS Word and MS Excel Format For Fast and Easy Editing

- All Charts and Graphs Automatically Update So You Can Complete Your Plan Quickly and Easily

- Includes All Sections and Complete Budget Needed For A Comprehensive Promotion Plan

- Shipped Lightning Fast On A High Capacity CD ROM

How would you like to start or expand your business with a professional marketing plan that’s designed to save you time and money and help generate tons of customers for your business? How great would it be to use a professional, proven marketing plan that is fine tuned to generate more customers for your business with a minimal investment of your time and money?

This May Be The Most Important Investment You’ll Make In Ensuring A Successful Launch Of Your Business!

This marketing plan will provide you with incredible secrets to generating and securing customers and powerful marketing techniques that provide a fantastic return on your advertising investment, and more! Take the first critical step towards a better quality of life and financial freedom right now!

You Need A Great Marketing and Promotional Plan If You Want To Succeed In This Business!

Developing a marketing plan is a critical step in starting any successful business, and it is not something you want to just jump into without experience and a little help to get you started.

Think about how much easier it’s going to be to using a complete, preformatted marketing plan specific to your business and industry, with all the required sections written for you, and all of the forms and budgets automatically generated for you!

Save countless hours of work and receive an incredibly valuable marketing plan that you can use to secure customers, generate sales, and manage your business marketing, advertising, and promotion expenses, and so much more!

This Marketing Plan Package Is The Solution

You’ve Been Looking For!

So why am I selling it at this price and giving you so much value for your money? Because I want to offer you a fantastic deal and help you get your business off to a solid start, so you recommend me to your friends and family, and leave great feedback! That means, over time, I can help more people enjoy the benefits of small business ownership!

List Price: $ 14.97

Price:

Find More Credit Scores Products

5 Ways To Boost Your Credit Score 100 Points!

5 Ways To Boost Your Credit Score 100 Points!

If you need help qualifying for a better rate on a loan or getting more credit, instantly increasing your credit score is probably the best way to do so.

You can save you thousands of dollars on your mortgage, auto loan and credit card interest rates just by having a higher credit score. Not only will “5 Ways to Boost Your Credit 100 Points” help you to improve your rating, but it explains where to find valuable resources that provide strategies on how to fight back against credit collectors and win!If you need help qualifying for a better rate on a loan or getting more credit, instantly increasing your credit score is probably the best way to do so.

You can save you thousands of dollars on your mortgage, auto loan and credit card interest rates just by having a higher credit score. Not only will “5 Ways to Boost Your Credit 100 Points” help you to improve your rating, but it explains where to find valuable resources that provide strategies on how to fight back against credit collectors and win!

List Price: $ 0.99

Price:

“No Credit, New credit, Low Credit Score: Expert Advise On Improving Credit Score” plus 3 FREE BONUSES books “Top 66 Ways To Save Money” $9.99 Value! … Best Self-Improvement E-Book” $12.99 Value! Reviews

“No Credit, New credit, Low Credit Score: Expert Advise On Improving Credit Score” plus 3 FREE BONUSES books including “Top 66 Ways To Save Money”!

Discover the quick and easy credit fix secret to boost your FICO score hundreds of points in a very short time period. Who Else Wants To Boost Their Credit Score To Repair Financial Damage Constantly Hanging Over Your Head? Don’t let bad credit hold you back from achieving what you and your family wants.

Discover the quick and easy credit fix secret to boost your FICO score hundreds of points in a very short time period. Who Else Wants To Boost Their Credit Score To Repair Financial Damage Constantly Hanging Over Your Head? Don’t let bad credit hold you back from achieving what you and your family wants.

Less than perfect credit is not a permanent situation. If you’ve made financial mistakes in the past (and who hasn’t), it’s not too late to start repairing your credit today. When you know the little tips and tricks you can use to convince the credit bureau’s your trust worthy. You can leave the loan officer’s chair confident that the deal will have a happy ending. It’s all about knowing how to play the credit game. And you can play the game like a master with…

“No Credit , New credit , Low Credit Score: Expert Advise On Legally Improving Credit Score”

Here is what you will learn quickly.

*Credit Repair,

*How to receive the absolute latest free credit report.

*Dispute bad items on your annual credit report.

*How to improve less than perfect credit?

*Obtain credit for bad credit, no credit, personal loads, business credit, and even online credit.

*3 top credit agencies and how to keep tabs on them.

*4 ways the credit bureau’s look at your lending history – and how important each view is.

*Easiest ways to fix bad items on your credit report.

*Boost your credit score (and it’s not just paying your bills).

*How to use your bank or credit union as an ally in your fight against bad credit.

*Debt consolidation and credit clean up.

*Dealing with credit score after bankruptcy, divorce, foreclosure, law suits, non-payment of taxes

Here is more of what you will learn right away.

*Setting goals on debt relief and curb your spending habit.

*Fight back against collection agency.

*Frequently asked questions and problems you need to know about.

*and much much more!!!

“Top 66 Ways To Save Money” – Free Today!!

Want to learn the top ways to save more money? We have them for you! We’ve compiled the 66 top ways from government agencies, consumer groups, business organizations, and educational institutions.

Keep your credit score and debt level down by paying with cash using these easy to follow money saving methods on…

Airline Fares, Car Rental, New Cars, Used Cars

Auto Leasing, Gasoline, Car Repairs, Auto Insurance

Homeowner/Renter Insurance, Life Insurance

Checking Accounts and Debit Cards, Savings Products

Credit Cards, Auto Loans, First Mortgage Loans, Mortgage Refinancing, Home Equity Loans

Home Purchase, Renting a Place to Live, Home Improvement

Major Appliances, Heating and Cooling, Telephone Service

Food Purchased at Markets, Prescription Drugs

How to…“Set up a FamilyBudget” – Free Today!!

Family Budgets: A Brief Introduction

• Why an e-book or how-to guide on setting up a family budget?

• Why would or do you need a family budget?

• The business case for and rationale behind family budgeting

• Benefits and advantages of a family budget

Family Budgets Defined

• What is a family budget?

• What constitutes a good family budget?

• What should it contain and look like?

The Family Budget Process

• How to set up a family budget?

• Some practical suggestions and a step-by-step summary of a family budget process

• Hints, tips, tricks and tools for setting up a family budget

• How should a family budget be used?

Final Thoughts On Setting Up A Family Budget

“The best Self-Improvement e-book” – Free Today!!

Part 1.pg 5

Entering the Phase State

Chapter 1 – General Background

Chapter 2 – Indirect Techniques

Chapter 3 – Direct Techniques

Chapter 4 – Becoming Conscious While Dreaming

Chapter 5 – Non-autonomous Methods

Part II.pg 91

Managing the Out-of-Body Experience

Chapter 6 – Deepening

Chapter 7 – Maintaining

Chapter 8 – Primary skills

Chapter 9 – Translocation and Finding Objects

Chapter 10 – Application

Part III.pg165

Auxiliary Information

Appendix.pg214

BONUS OFFERS ALL FREE TODAY!!

List Price: $ 6.99

Price: